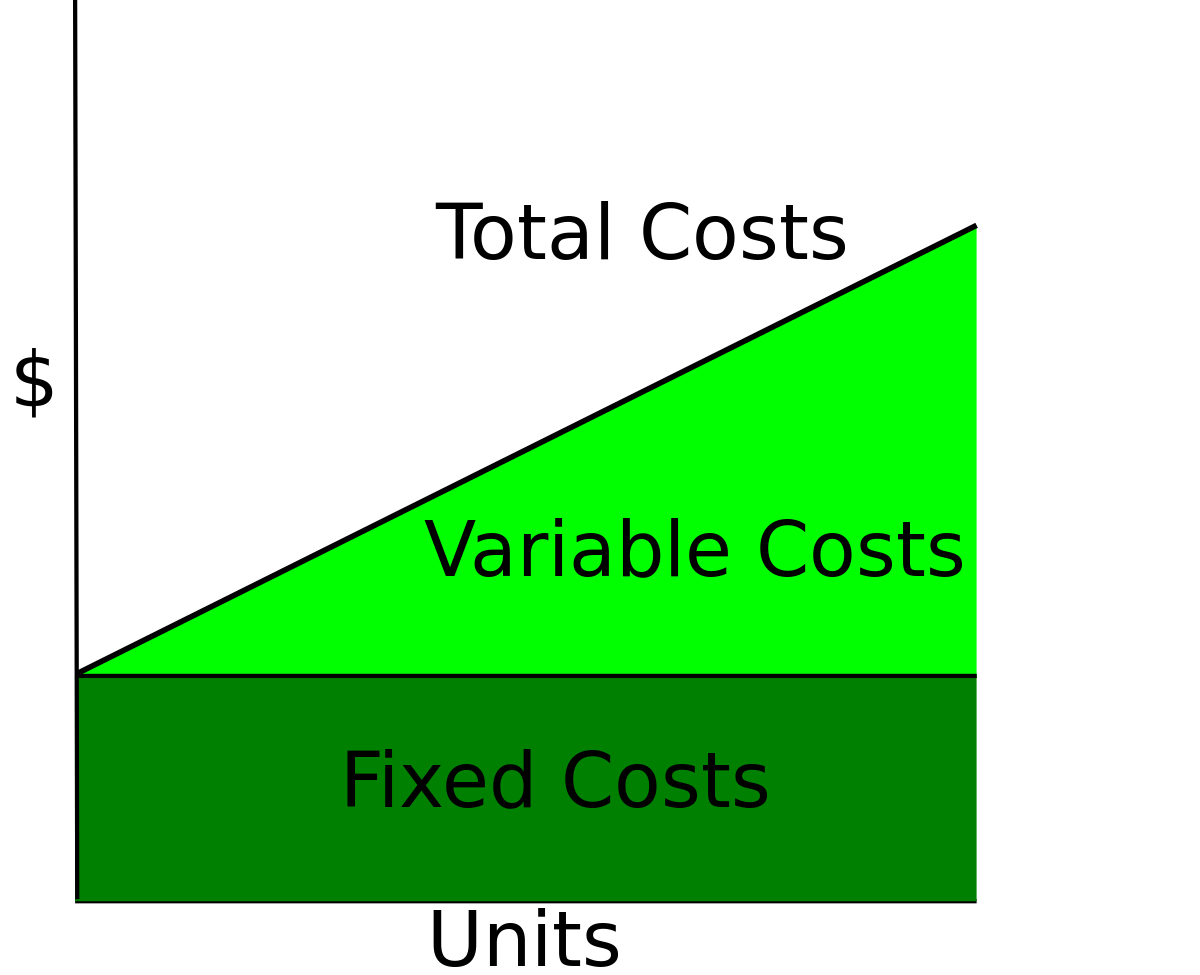

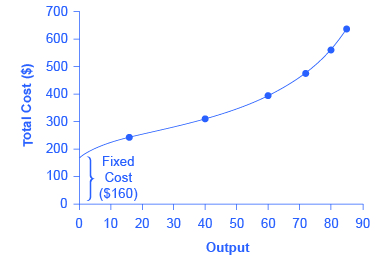

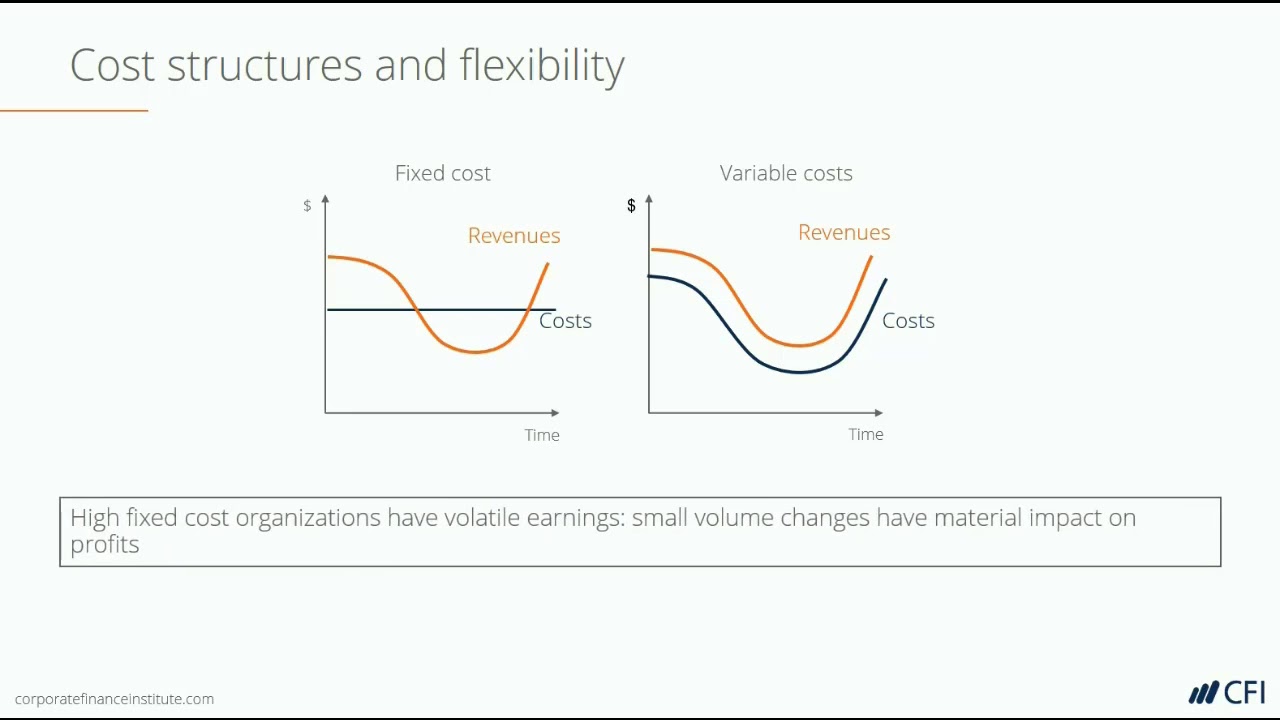

Overhead Costs (Definition and Examples) By Bryce Warnes on In simple terms, overhead is the cost of keeping your business afloat Overhead is a summary of the costs you pay to keep your company running, and appears on your monthly income statement When you track and categorize your overhead, you can plan around expensesFixed cost vs variable cost is the difference in categorizing business costs as either static or fluctuating when there is a change in the activity and sales volume Fixed cost includes expenses that remain constant for a period of time irrespective of the level of outputs, like rent, salaries, and loan payments, while variable costs are expenses that change directly and proportionally to theDefinition Short Run Cost is the cost price which has shortterm inferences in the manufacturing procedures, ie, these are utilised over a short degree of end results These are the cost sustained once and cannot be used again, such as payment of wages, cost price of raw materials, etc, In a shortrun, at least 1 aspect of production is

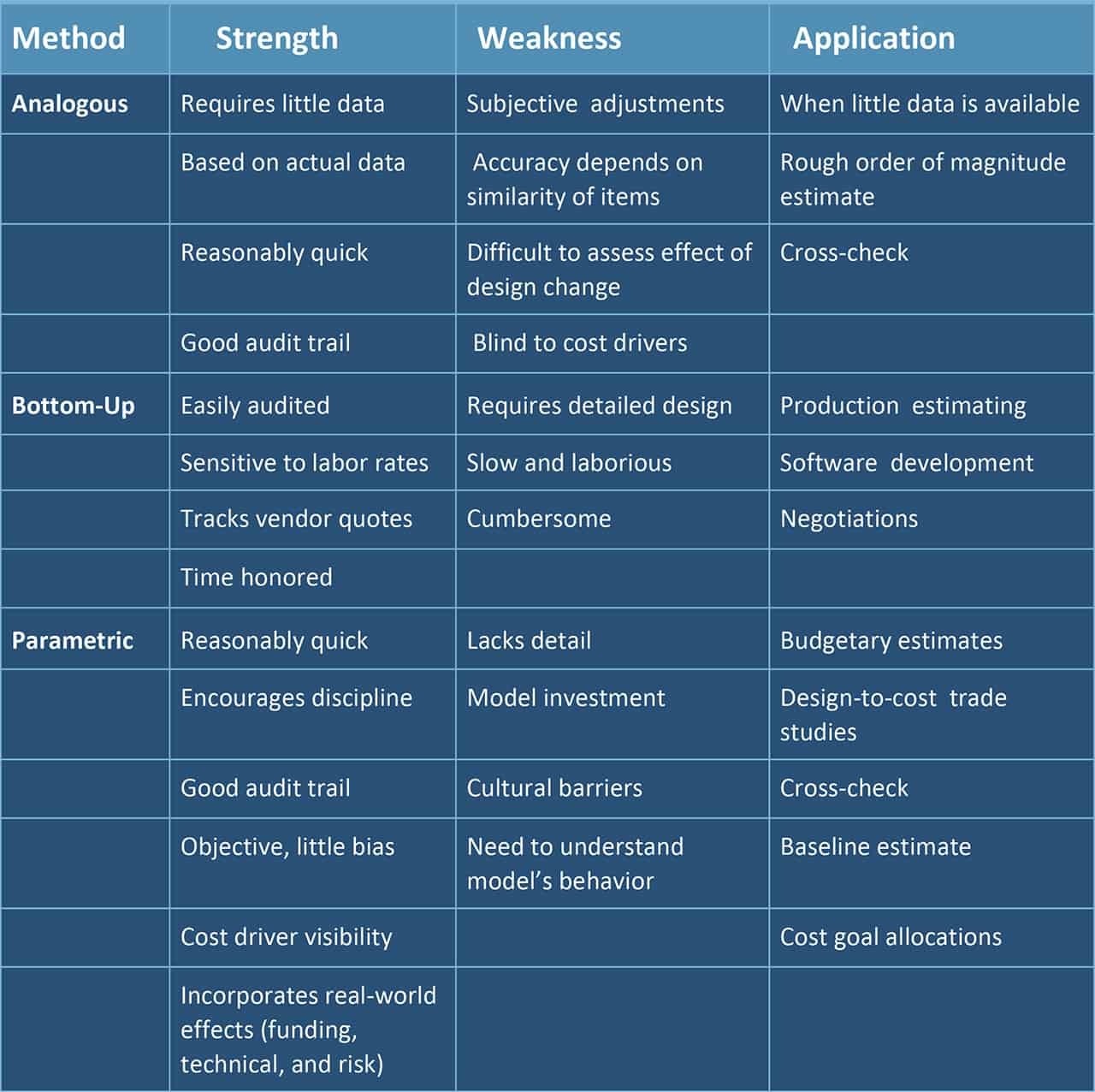

Ultimate Guide To Project Cost Estimating Smartsheet

What does running cost mean

What does running cost mean- The operating costs of a business are generally the costs associated with maintaining the existence of the business The operating costs are the recurring costs that the business owner must pay on a regular basis weekly, monthly or yearly Some operating costs may remain the same on a continuous basis, while otherThe money that you spend regularly to operate a machine or to manage a business or service Synonyms and related words Definition and synonyms of running costs from the online English dictionary from Macmillan Education This is the British English definition of running costs

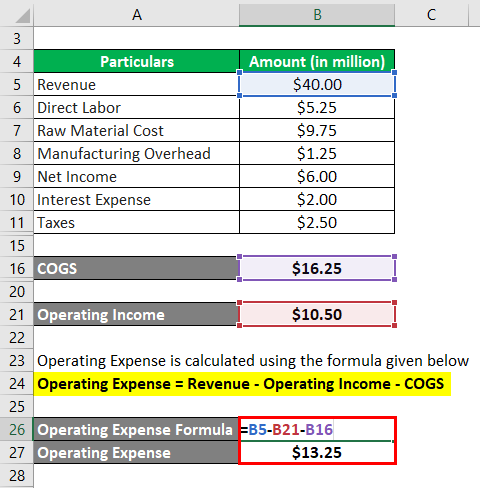

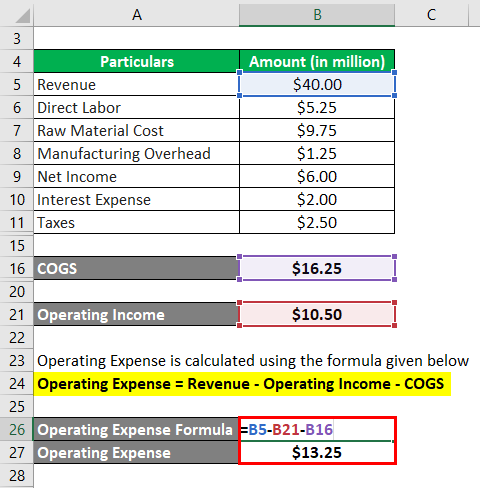

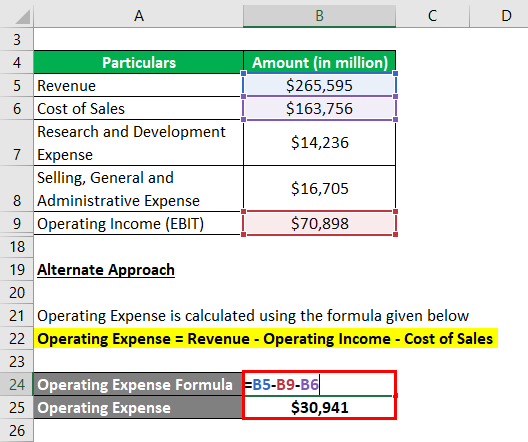

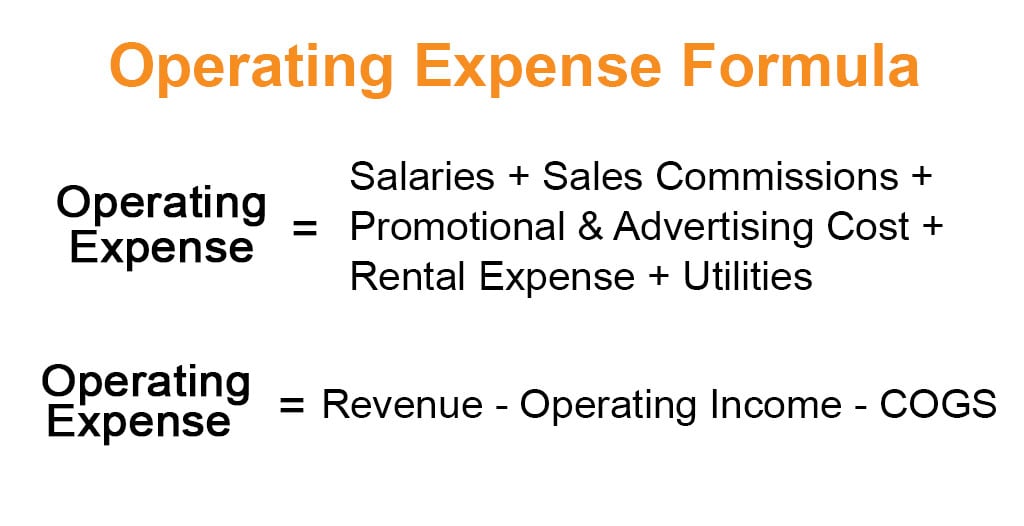

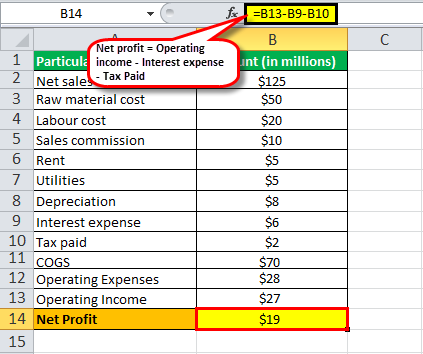

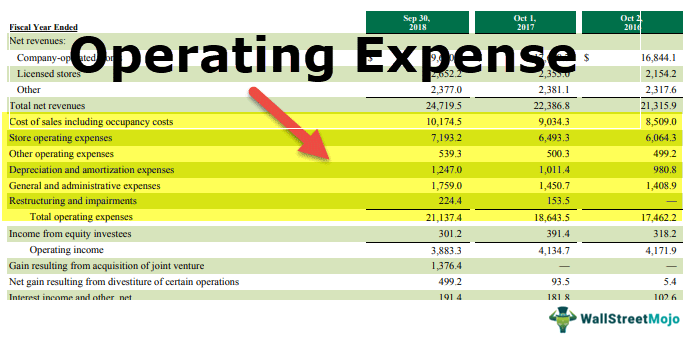

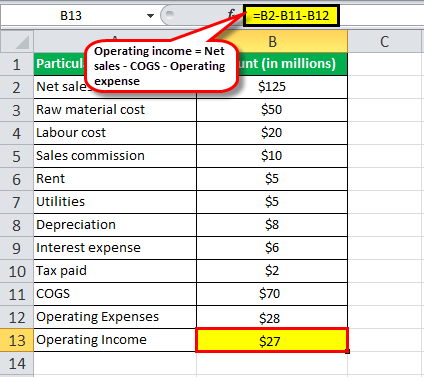

Operating Expense Formula Calculator Examples With Excel Template

You need to consider annual road tax, fuel, the cost of any work that comes from a service or the MOT, and, of course, any other repairs that crop up over the year Understanding Startup Costs According to a wellcited study from the Kauffmann Foundation, a small business startup takes an average of $30,000 to get off the ground and running There are businesses that take $300 and $3 million, but this average figure gives you a good ballpark estimate of what many entrepreneurs are forking overWe all know that running a car can be expensive But have you ever thought about what the costs can be?

Running costs Need synonyms for running costs?What is another word for running costs? Costs are mandatory expenses which are made in order for the smooth running of a business Every part of the business is associated with different types of business costs right from production up till marketing and even sales The cost of labor for instance which is used to produce goods or render services is measured in terms of benefits or raises or even salaries

The short run costs increase or decrease based on variable cost as well as the rate of production If a firm manages its short run costs well over time, it will be more likely to succeed in reaching the desired long run costs and goals Key Terms variable cost A cost that changes with the change in volume of activity of an organizationRun rate is the financial performance of a company, using current financial information as a predictor of future performance The run rate assumesRunning cost definition the money you need to spend regularly to keep a system or organization working Learn more

Methodology For Starting A Business

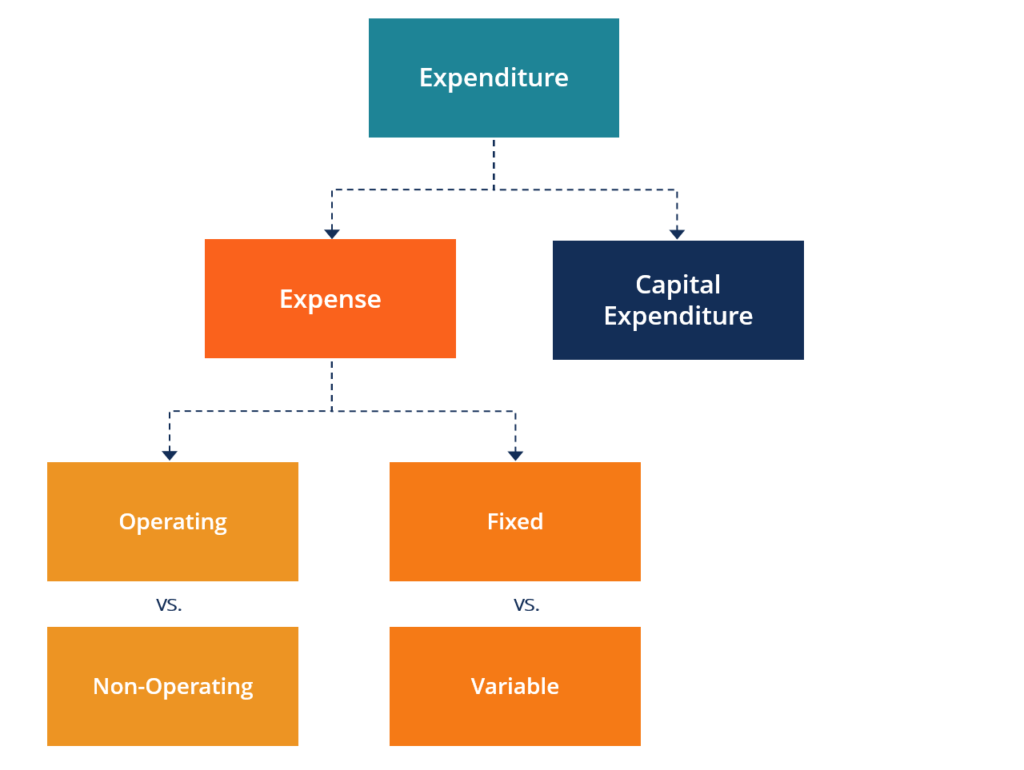

What Is Capex And Opex Comindware Blog

A good budget helps, but there are many hidden costs of running a business that can quickly run you into the red These overlooked items include 1) Permits, Licenses and Dues It all starts with paper – the permits and licenses you might need to do business in your community These are rarely onetime expensesThe Primary Business Startup and Organizational Costs Example Business Startup Costs W hen a new business is starts in the United States, eligible startup costs and organizational costs qualify as capital costs which the firm can amortize across a specific timespan (see the links to tax information in the following section for more details on US rules and specifics for other countries) What are the costs of running a car?

Cost Object Meaning Advantages Types And More

How To Calculate Small Business Startup Costs 21 Complete Guide

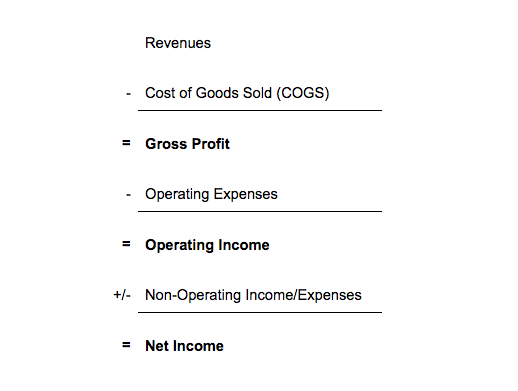

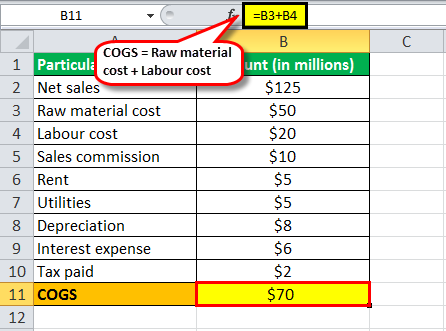

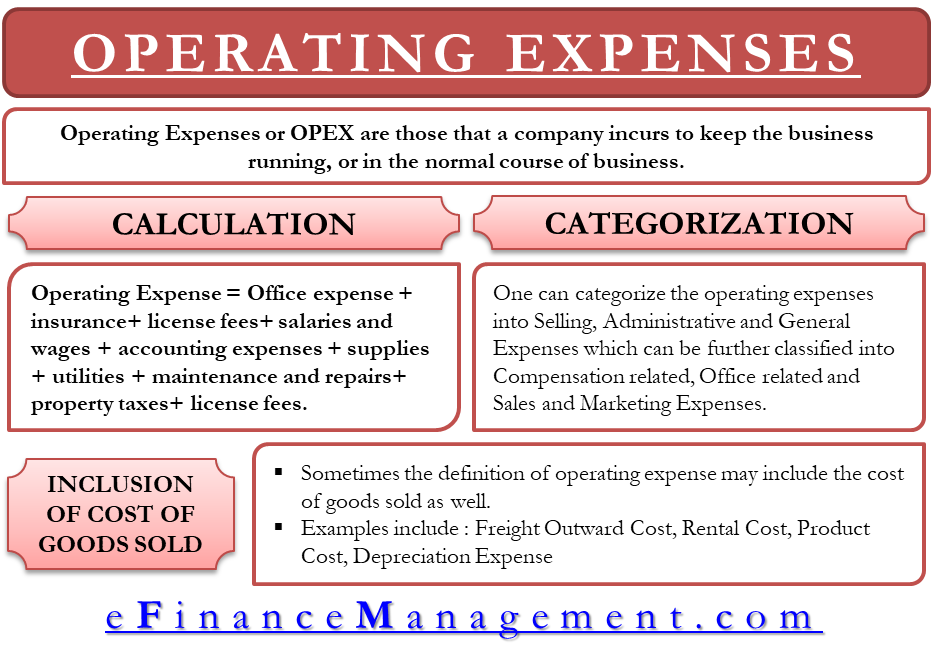

When you operate a small business, you have two types of costs fixed costs and variable costs Fixed costs do not change with the amount of the product that you produce and sell, but variable costs do A change in your fixed or variable costs affects your net income It also affects your company's breakeven point Operating costs are those required for the daytoday maintenance and administration of your business People also commonly refer to operating costs as operating expenses, operational expenses, operating expenditures, operational expenses, or OPEX One of the primary components of operating costs is the cost of goods sold (COGS)In otherwords—Real cost signifies the aggregate of real productive resources absorbed in the production of a commodity or a service Marshall has described "real cost" as the production of a commodity generally requires many different kinds of labour and the use of capital in many forms The exertions of all the different kinds of labour that are directly or indirectly involved in

Expenses Definition Types And Practical Examples

Operating Expense Formula Calculator Examples With Excel Template

A proactive approach can help the business to reduce the chances of cost overrun with proper planning and a thorough analysis of the estimates Recommended Articles This article has been a guide to What is Cost Overrun & Meaning Here we discuss the types of cost overrun, characteristic, and how to avoid along with causes and preventionFinancing Costs Definition Financing costs are defined as the interest and other costs incurred by the Company while borrowing funds They are also known as "Finance Costs" or "borrowing costs" A Company funds its operations using two different sources None of the financings comes as free for the Company Equity investors In the business, costs are simply a monetary valuation of various factors like Salary Paid to Employees, Raw Material Consumed, Various Utility Consumed and Opportunities forgone for producing a particular product

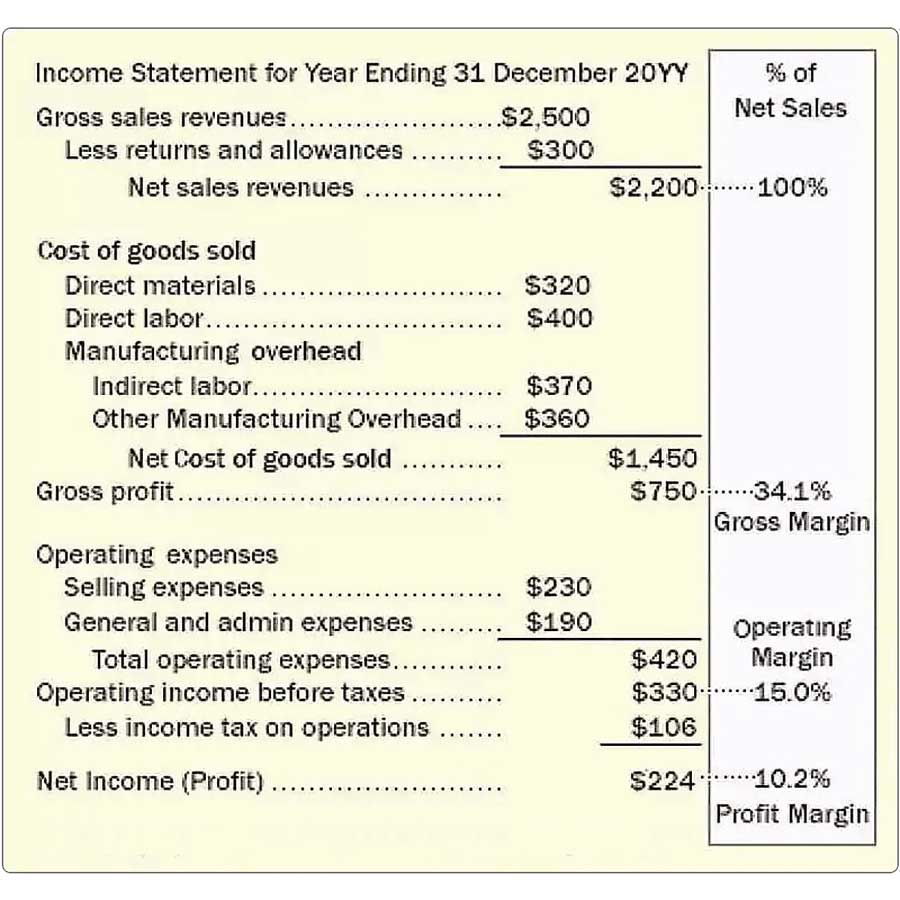

Margins Measure Business Profitability And Reveal Leverage

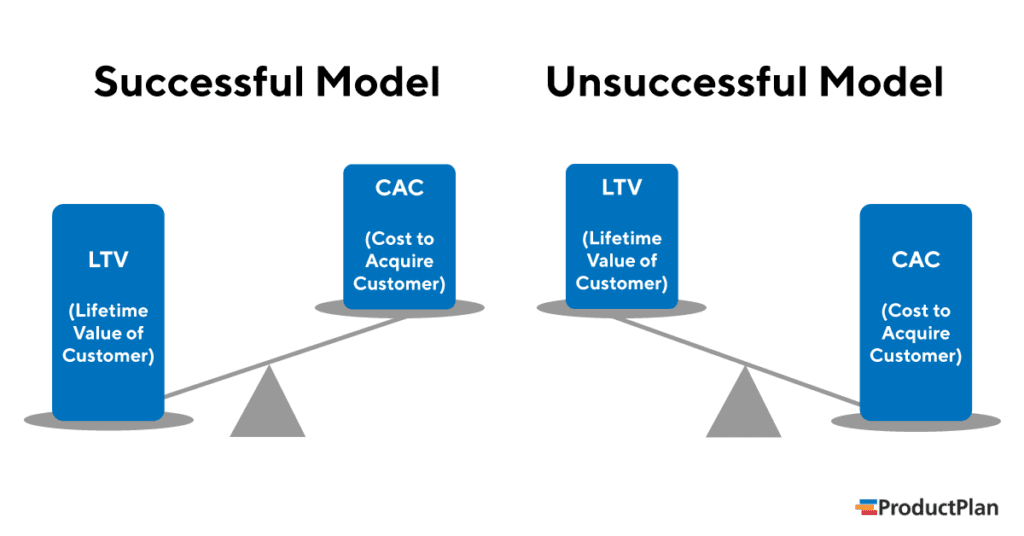

Customer Acquisition Cost Cac Formula And Examples

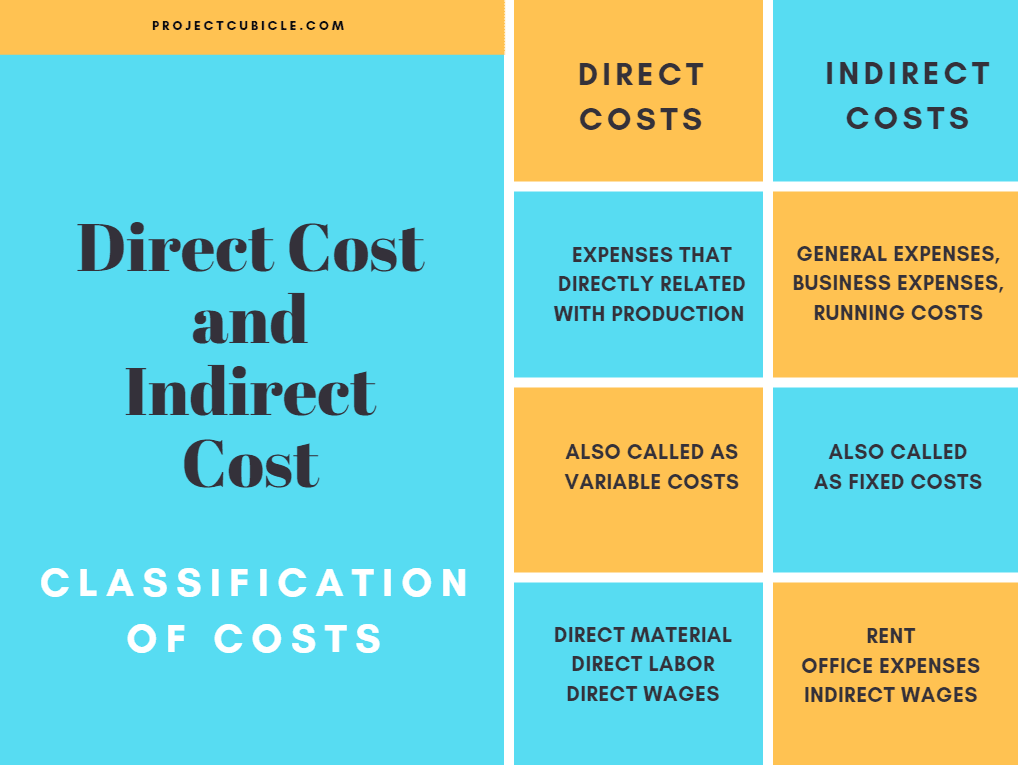

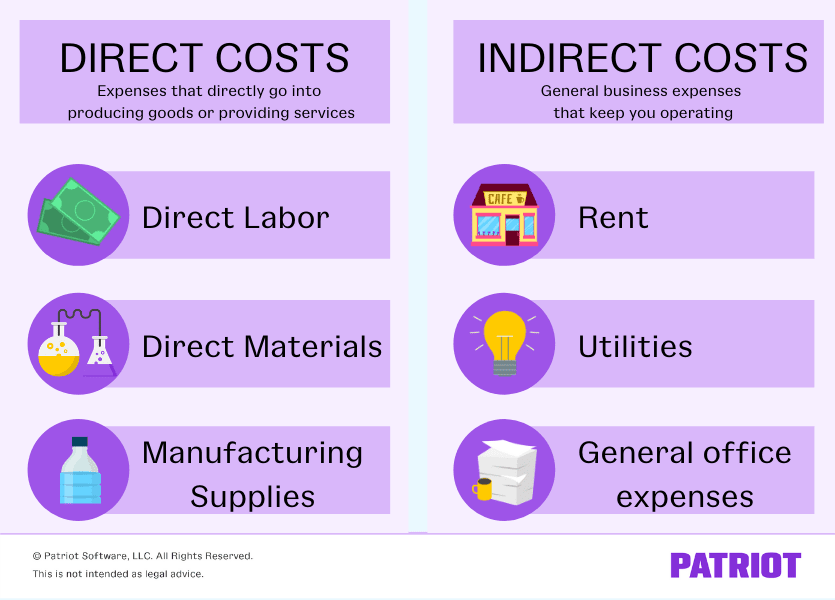

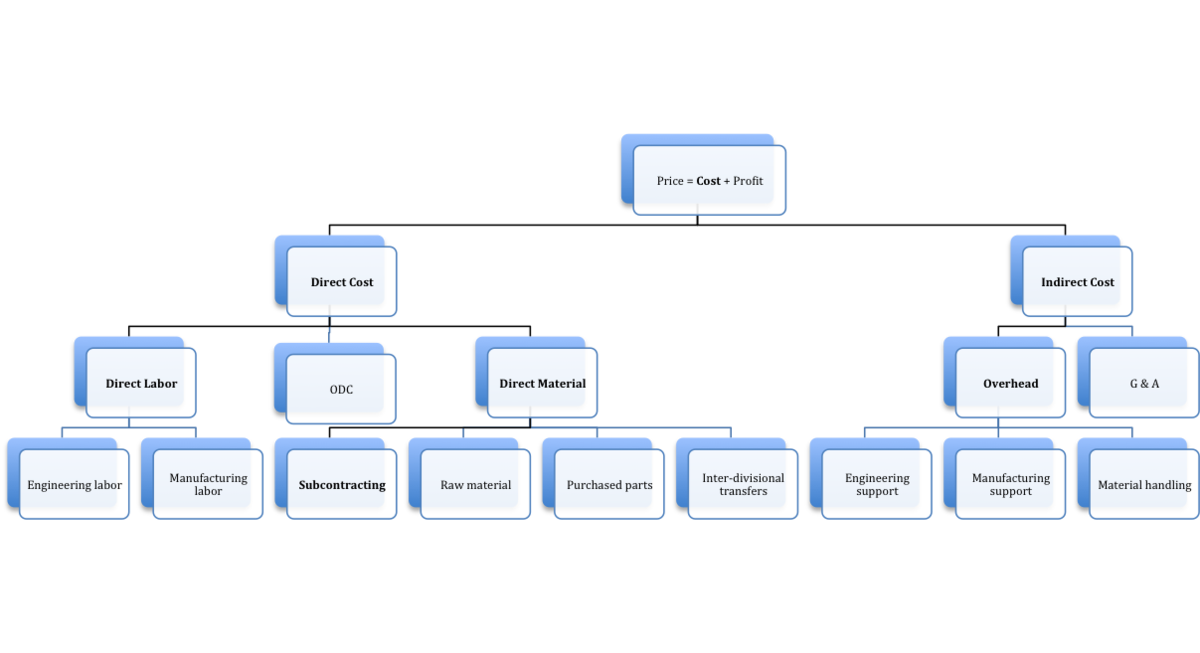

A direct cost is totally traceable to the production of a specific item, such as a product or service For example, the cost of the materials used to create a product is a direct cost There are very few direct costs The cost of any consumable supplies directly used to manufacture a product can be considered a direct costThe running costs of a business are the amount of money that is regularly spent on things such as salaries, heating, lighting, and rentA cost of doing business could be a direct cost, like raw materials, or an indirect cost, like building security Regardless of type, such costs must be considered carefully by managers, business owners, and anyone involved in running a company, since the amount of such costs will play a large role in determining if a company is profitable or not

Fixed Cost Definition 6 Examples Vs Variable Cost Boycewire

Cost Structure Learn About Cost Allocation Fixed Variable Costs

The point is to divide up all activities in the company into Running or Changing Running refers to normal business activities and daily operations with clear processes while Changing refers to You don't want to run out of cash before you have the chance to start making a profit Pay attention to the hidden costs of running a business Some business expenses, like the cost of your products, are clear But, others are harder to anticipate Look out for less obvious startup costs when you plan your companyHere's a list of similar words from our thesaurus that you can use instead Noun The general costs of running a business, such as rent, electricity, and stationery overheads

/dotdash_Final_How_operating_expenses_and_cost_of_goods_sold_differ_Sep_2020-01-558a19250f604ecabba2901d5f312b31.jpg)

How Operating Expenses And Cost Of Goods Sold Differ

Fixed Cost Wikipedia

C = f (Q,T,Pf,K) Where C is total cost The run rate concept refers to the extrapolation of financial results into future periods For example, a company could report to its investors that its sales in the latest quarter were $5,000,000, which translates into an annual run rate of $,000,000 It is based on the assumption that current results will continue into the futureRunning costs (n) 1 (trade) the expense of maintaining property (eg, paying property taxes and utilities and insurance);

Difference Between Controllable And Uncontrollable Cost Difference Between

Understanding Profitability Ag Decision Maker

1 nplural The running costs of a business are the amount of money that is regularly spent on things such as salaries, heating, lighting, and rent (BUSINESS) (=overheads) The aim is to cut running costs by £90 million per year There are many hidden costs of running a business when you add payroll to the mix Employee expenses include taxes, training costs, and benefits, in addition to regular wages If you aren't trained on the hiring process steps, you could end up losing a lot of time and money before you even add an employee to your payroll #8Operating costs are those expenses that cover the costs of running the business and making a product or service For nonprofits that don't make or sell a product, fundraising, or development, costs are considered similar to manufacturing costs Understanding these expenses will help you create accurate budgets for a nonprofit organization

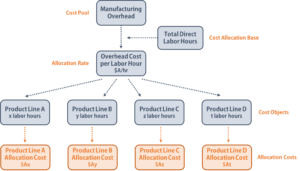

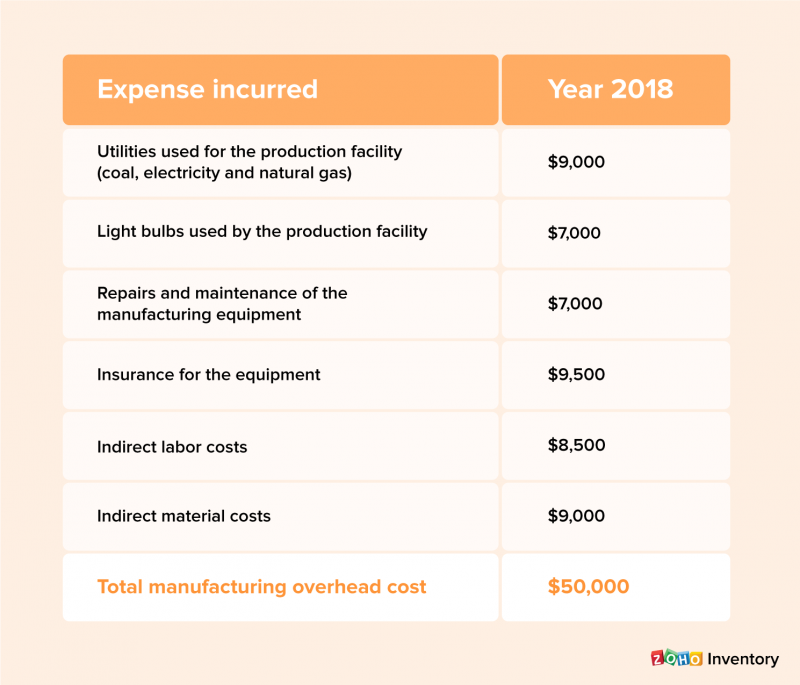

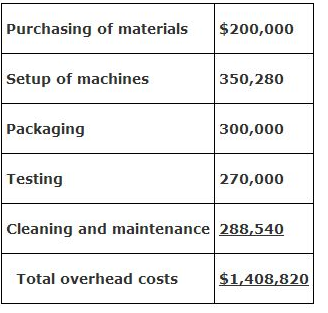

Manufacturing Overhead Cost How To Calculate Moh Cost Zoho Inventory

Operating Expenses A Complete Guide Bench Accounting

Definition A cost is an expenditure required to produce or sell a product or get an asset ready for normal use In other words, it's the amount paid to manufacture a product, purchase inventory, sell merchandise, or get equipment ready to use in a business processDefinition of Operating Cost Operating cost can be defined as the cost of running the administrative and maintenance functions of a business on a daily basis Operating cost is an element of a business' operating income as reflected in The average cost of running a small business expenses to consider Whether you plan on starting a new business or want to benchmark the running costs of an existing organisation, having an idea of the average cost of running a small business is a fundamental stepping stone to SME success

Car Costs Wikipedia

Operating Expense Formula Calculator Examples With Excel Template

It does not include depreciation or the cost of financing or income taxesAdministrative costs are costs related to the normal running of the business and may include costs incurred in paying salaries to a receptionist, accountant, cleaner, etc Such costs are treated as overhead costs since they are not directly tied to a particular function of the business and they do not directly result in profit generationOverhead costs, often referred to as overhead or operating expenses, refer to those expenses associated with running a business that can't be linked to creating or producing a product or service They are the expenses the business incurs to stay in business, regardless of its success level Overhead costs are all of the costs on the company

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-02-6a82acc4cf2d4434a77899c09d49e737.jpg)

Financial Statements Definition Types Examples

Overhead Cost Definition Calculation More Insight For Business

Factors are variable, all costs are also variable Symbolically, we may write the longrun cost function as C = f (Q,T,Pf,) and shortrun cost function as;Definition The Shortrun Cost is the cost which has shortterm implications in the production process, ie these are used over a short range of outputThese are the cost incurred once and cannot be used again and again, such as payment of wages, cost of raw materials, etc In business, sustainability refers to doing business without negatively impacting the environment, community, or society as a whole Sustainability in business generally addresses two main categories The goal of a sustainable business strategy is to make a positive impact on at least one of those areas

Operating Expense Formula Calculator Examples With Excel Template

1

Starting a business is not cheap, with the average startup cost running around $30,000 And that doesn't even include the money needed to keep the business operating If you're going to start a business, you need to get your bearings straight Failure to do so could result in the failure of your business and — in some cases —Running costs definition 1 the money you need to spend regularly to keep a system or organization working 2 the money you Learn moreOperating costs are the ongoing expenses incurred from the normal daytoday of running a business Operating costs include both costs of goods sold (COGS) and other operating expenses—often called

6 Top Tips To Help You Save On Your Business Running Costs Gompels Healthcare

Opex Vs Capex The Real Cloud Computing Cost Advantage 10th Magnitude

Running costs definition, meaning, English dictionary, synonym, see also 'running belay',running board',running commentary',running head', Reverso dictionary, EnglishRunning an online business *does* come with a cost Of course, my costs are relatively low compared to say, someone who owns a storefront and pays rent, but still, running any kind of business, online or not, requires you to spend moneyBusiness operating costs For a commercial enterprise, operating costs fall into three broad categories fixed costs, which are the same whether the operation is closed or running at 100% capacity Fixed Costs include items such as the rent of the building These generally have to be paid regardless of what state the business is in

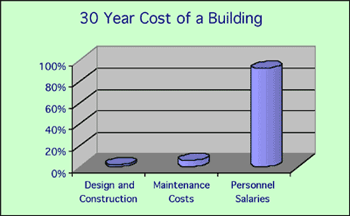

Understanding Tco Origins Definition Calculation And Advantages

Overheads Definition Types And Practical Examples

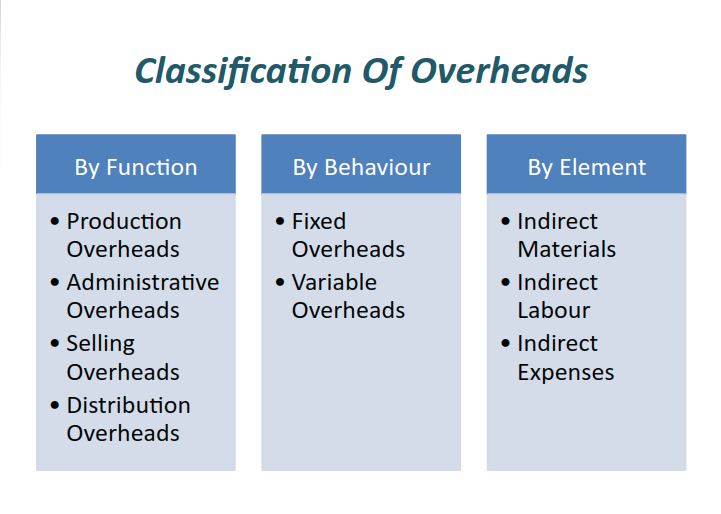

Definition The Business Cost includes all the costs (fixed, variable, direct, indirect) incurred in carrying out the operations of the business It is similar to the real or actual costs that include all the payments and contractual obligations along with theOverhead costs refer to all indirect expenses of running a business These ongoing expenses support your business but are not linked to the creation of a product or service Calculating overhead costs is not just important for budgeting but also determining how much the business should charge for a service or product to make a profitAn individual with the desire to start a business has to pay for many previous expenses long before it starts producing any money These expenses come from things like legal fees, market research reports, hiring staff, insurance, advertisement, training expenses and other operating costs that come from organizing the business before it goes live

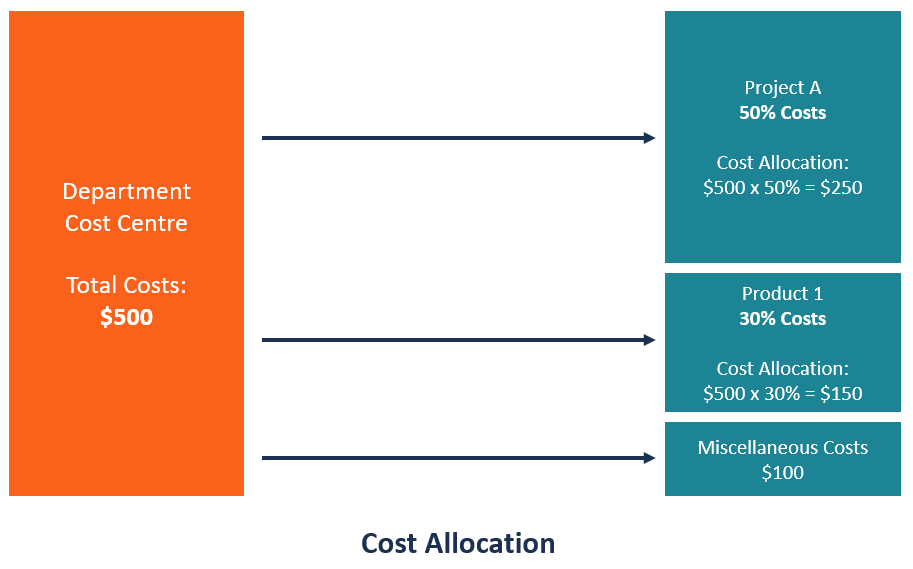

Cost Allocation Overview Types Of Costs Mechanism

Operating Expenses A Complete Guide Bench Accounting

Paid to a vendor or service provider Paid by a customer There's a tendency to confuse cost with price, and they're often used interchangeably in informal conversations, but they aren't the same The amount that a business charges customers per unit of the product or service it sells is called the price In total, in 16, I spent $9,424 on my business Pretty eyeopening, huh?

What Is Cost Benefit Analysis Examples And Steps Thestreet

Understanding Profitability Ag Decision Maker

Is Your Company Profitable 5 Simple Steps To Check Your Numbers

Difference Between Controllable And Uncontrollable Cost Difference Between

Operating Expense Definition Formula Calculate Opex

Fixed And Variable Expenses Inc Com

Restaurant Startup Costs The Real Cost Of Opening And Operating A Restaurant Lightspeed Hq

Long Run Cost Curves Total Average And Marginal Costs With Examples

Incurred Cost Meaning Examples Top 10 Types Of Incurred Cost

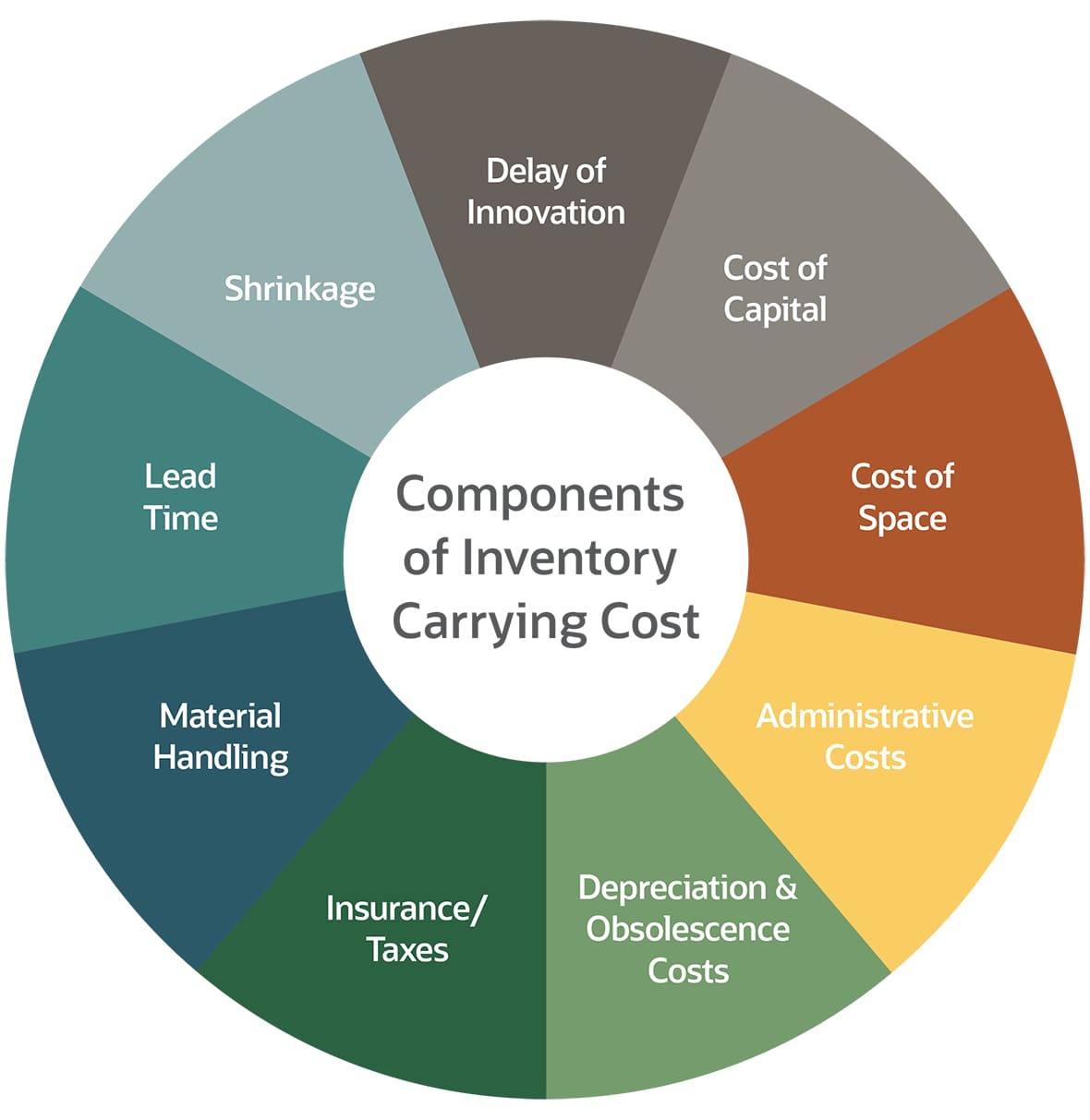

Inventory Carrying Costs What It Is How To Calculate It Netsuite

How To Calculate Food Cost Percentage With Examples Lightspeed Hq

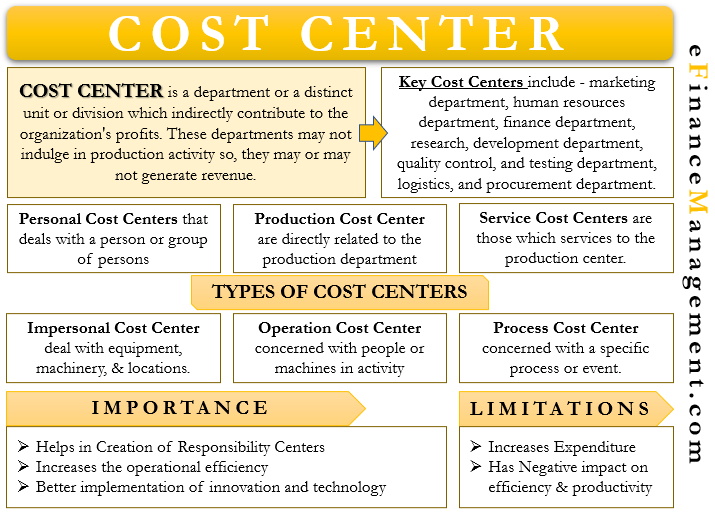

Cost Center Meaning Types Importance Limitations

10 Types Of Business Costs Which A Business Has To Bear

Capex Vs Opex Capital Expenditures Operating Expenses Explained Bmc Software Blogs

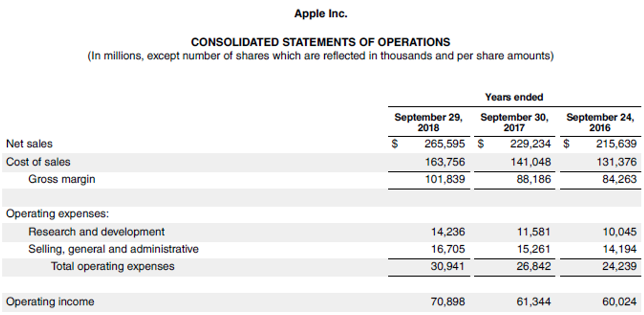

/Apple10K-97033366f9974bb6990acbe1b3e2c277.jpg)

Operating Cost Definition

Theory Of Production Economics Britannica

1

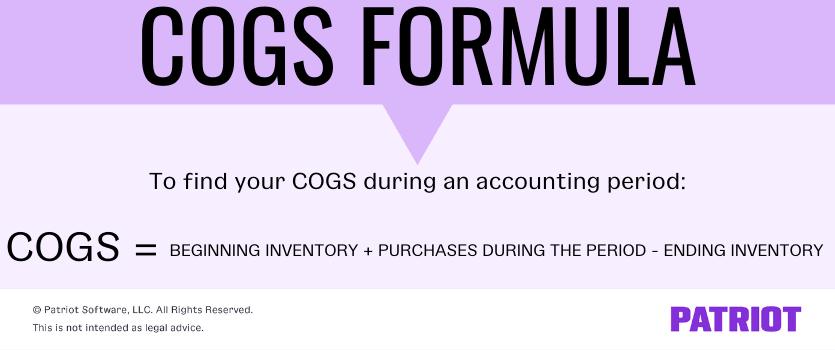

Cost Of Goods Sold Cogs Definition Formula More

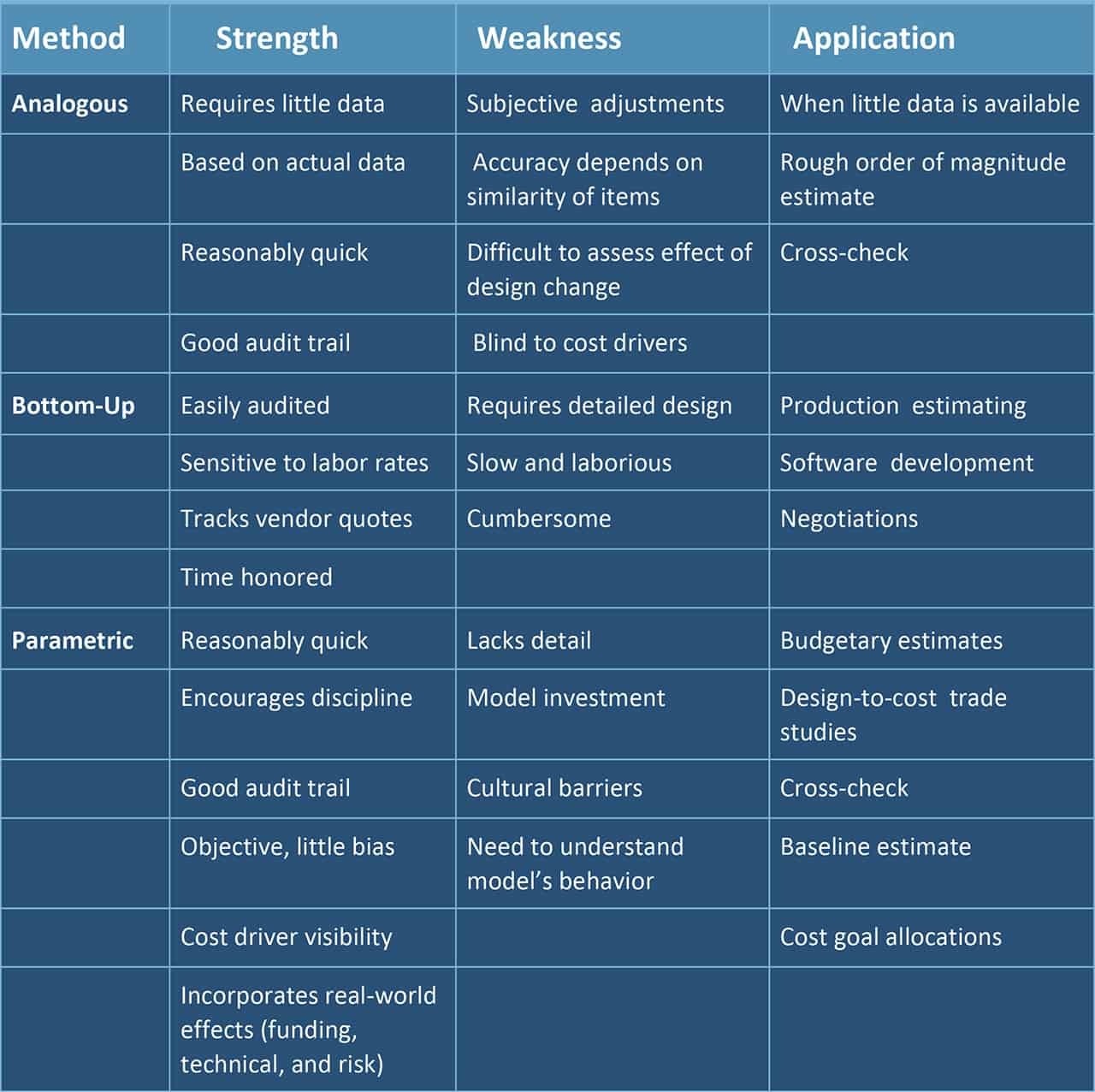

Ultimate Guide To Project Cost Estimating Smartsheet

Operating Costing Definition Classification Of Operating Cost

How To Calculate Small Business Startup Costs 21 Complete Guide

7 2 The Structure Of Costs In The Short Run Principles Of Economics

/a-guide-to-fixed-and-variable-costs-of-doing-business-393479_FINAL2-efbe65d5befe4d3bbe896f2376c755f9.png)

Fixed And Variable Costs When Operating A Business

/dotdash_Final_Operating_Income_Aug_2020-01-e3ccd90db6224fc8b0bea6dac86e478f.jpg)

Operating Income Definition

Cost Of Sales Formula Calculator Examples With Excel Template

Labor Cost Definition And Formula What Is Labor Cost

Cost Structure Learn About Cost Allocation Fixed Variable Costs

How Much Does It Cost To Host A Website Compare 21 Prices

Operating Expense Definition Formula Calculate Opex

/a-guide-to-fixed-and-variable-costs-of-doing-business-393479_FINAL2-efbe65d5befe4d3bbe896f2376c755f9.png)

Fixed And Variable Costs When Operating A Business

:max_bytes(150000):strip_icc()/Apple10K-97033366f9974bb6990acbe1b3e2c277.jpg)

Operating Cost Definition

Direct Costs Vs Indirect Costs What Are They And Why Businessnewsdaily Com

Overhead Costs Definition Classifications And Examples

How To Calculate Small Business Startup Costs 21 Complete Guide

Fixed Cost Definition 6 Examples Vs Variable Cost Boycewire

Costing

/dotdash_Final_How_operating_expenses_and_cost_of_goods_sold_differ_Sep_2020-01-558a19250f604ecabba2901d5f312b31.jpg)

How Operating Expenses And Cost Of Goods Sold Differ

Marginal Cost Average Variable Cost And Average Total Cost Video Khan Academy

Operating Expenses Meaning Importance And More

Operating Costing Definition Classification Of Operating Cost

Cost Plus Pricing Strategy Profitwell

List Of Operating Expense Complete List Of Items In Operating Costs

Overhead Cost Definition Calculation More Insight For Business

Direct Costs And Indirect Costs Cost Classification Projectcubicle

Fixed Cost Definition 6 Examples Vs Variable Cost Boycewire

What Is Revenue Run Rate Formula How To Calculate

3

Overhead Business Wikipedia

Direct Vs Indirect Costs Breakdown Examples Why It Matters

What Is Capex And Opex Comindware Blog

Operating Expense Definition Formula Calculate Opex

Operational Metrics Kpi Examples Meaning Business Tips

Understanding Tco Origins Definition Calculation And Advantages

Cost Breakdown Analysis Wikipedia

How To Calculate Small Business Startup Costs 21 Complete Guide

Car Costs Wikipedia

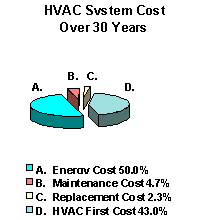

Life Cycle Cost Analysis Lcca Wbdg Whole Building Design Guide

Net Profit Margin Definition How To Calculate It Tide Business

Cost Behavior Meaning Importance Types And More

1

Capex Vs Opex Capital Expenditures Operating Expenses Explained Bmc Software Blogs

Cost Structure Learn About Cost Allocation Fixed Variable Costs

How To Calculate Small Business Startup Costs 21 Complete Guide

Opex Vs Capex The Real Cloud Computing Cost Advantage 10th Magnitude

/opportunity-cost-definition-393313-FINAL-06131b369c8e4acdbc81d996f20cf4cb.png)

Opportunity Cost What Is It And How To Calculate It

Overhead Costs Definition Classifications And Examples

A Beginners Guide To Capex Vs Opex Software Advisory Service

What Is Revenue Run Rate Formula How To Calculate

Operating Expense Definition Formula Calculate Opex

What Is A Cost Sheet Definition Example Format Of Cost Sheet Zoho Books

/Apple10K-97033366f9974bb6990acbe1b3e2c277.jpg)

Operating Cost Definition

What Are Business Expenses Deductible Non Deductible Costs

Operating Expense Definition Formula Calculate Opex

Life Cycle Cost Analysis Lcca Wbdg Whole Building Design Guide

Operating Expense Formula Calculator Examples With Excel Template

Life Cycle Costing Definition Process Example More